The goverment by controlling the prices is driving the sector to bankruptcy. Trying all kinds of permutations to keep the companies from going bankrupt (see article below). If the oil companies cannot charge market rate (shareholders subsidizing the customer ???!!) , then how is the sector going to make money.

I am still not able to get it (maybe i am missing something ). If the government ( the majority shareholder ) controls the pricing (and profit) of the oil companies at the expense of the minority shareholder with no concern other than the political impact, what is the value of these companies ? how does one value such companies where the future cash flow in addition to being dependent on a volatile oil market is also dependent on a whimsical majority shareholder which has a non economic agenda ! . This sector would start looking like indian railways if the oil prices remain high (which looks likely), that is chronically sick

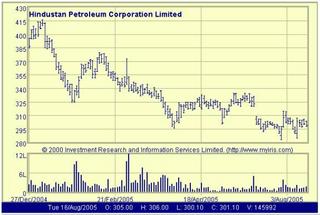

typically oil companies make good profits through forward contracts, hedging etc during rising oil prices (more so if they are vertically integrated). But the indian oil companies are actually down when the overall market is up ( see chart )

To provide cushion for under-recoveries — Standalone refineries may be merged with oil marketing cos --- From hindu business line

Our Bureau

New Delhi , Aug. 17

THE Ministry of Petroleum & Natural Gas is weighing the option of merging pure refining companies with oil marketing companies (OMCs) to enable the latter to cushion the impact of high global crude oil prices on their bottomline.

Due to the freeze by the Government on raising retail prices despite the rise in raw material cost, the fuel retailing business is seen as becoming economically unviable, resulting in OMCs such as Indian Oil Corporation, Bharat Petroleum Corporation, Hindustan Petroleum Corporation and IBP suffering losses.

However, standalone refiners in Chennai, Kochi and Mangalore are making profits as they get the international price for the fuel they produce.

Asked whether the Petroleum Ministry was contemplating such a move, the Petroleum Secretary, Mr S.C. Tripathi, told Business Line that, "various options are being considered. In view of the high crude oil price scenario, some serious structural changes could be made in the downstream sector."

About the suggestion made by the Committee on Synergy in Energy to oil companies asking them to consolidate their businesses, the Secretary said, "we are keeping that also in view."

Explaining the rationale behind such a consideration, a Petroleum Ministry official said standalone refiners were currently earning huge margins, while the OMCs were taking a hit. The merger could help in sharing refining margins with OMCs. "But this is a long-term view and may take some time," he said.

Meanwhile, the bleeding OMCs have been seeking a revision in the prices of the four petroleum products - kerosene, LPG, petrol and diesel.

The companies have incurred a cash loss of Rs 1,516 crore in July. They have sought Rs 5.29 per litre increase in petrol and Rs 4.54 a litre hike in diesel prices. Indications are that the Government is unlikely to consider the price revision before the end of the current session of Parliament.

Also, negotiations were on with the Finance Ministry to consider an excise duty cut, senior officials said.

The Government may consider a hike between Rs 1 and 2 per litre each combined with excise duty reduction on petrol from 8 per cent plus Rs 13 a litre to 8 per cent plus Rs 12 a litre and that on diesel from 8 per cent plus Rs 3.25 a litre to 8 per cent plus Rs 2.25 per litre.

No comments:

Post a Comment