December 23, 2010

Arbitrage - Kesar enterprise

This deal was announced in March and it took around 9 months for the deal to complete. I have also listed some thoughts and analysis (which include substantial inputs from ninad) over the course of the deal at various points of time

Basic idea

Kesar enterprise is a sugar company with a division which was expanding into the warehousing and other port related infrastructure such as storage. The company announced in Dec 2009 that they would be demerging the infrastructure business. You can find the announcement here.

I am posting my personal notes on the deal below

De-merger evaluation – March 19th

Kesar enterprises has announced the de-merger of its Sugar biz from the Infrastructure warehousing biz.

The numbers for each biz is as follows (in crs)

Warehouse/ transport divison

Revenue: 16 Crs (2010 expected)

PAT: 7-8 crs

Return on assets – 30%+

Valuation – around 60-70 crs minimum

Sugar divison

Revenue – 285 crs gross including excise

PAT – 2-3 crs.

Over 10 years the company has made very small profits. So difficult to value based on profits.

Inverting the problem - Mcap of the company is 82 crs. So is the sugar biz atleast 20-30 crs?

Alternative valuations

Book value – 40-50 crs (after all debt). So liquidation value is higher

Comparative valuation – based on price / sales, most of companies in this sector are priced around 1-2 times. Due to poor profitability, we can price this company at 50% of sales – 100 crs?

On capacity basis, a comparable company like dhampur sugar (UP based company), sells for 0.011 Crs/ TCD. Kesar enterprise sugar business can then be valued at 80 crs.

So total conservative value is around 140-200 crs.

Action plan – create initial position at 120 levels

Negative case – March 30th

Sugar prices tumbling and market has caused the stock prices to drop by 30% in feb and march. Kesar has seen stock price drop by 10-15%.

2011 will see surplus sugar and hence the futures have started going down. Stock prices could drop

further – if that is the case, delay increasing the position, close to the ex-date as possible

Debt getting split – more to infra company: need to track this

Midcap discount – look at midcap futures to hedge?

How to hedge against drop in sugar industry – can use puts on Balrampur chini and Bajaj Hindustan

Stock goes ex-date - May 19th

The ex-date was 14-May. The sugar business has dropped to around 50 rs which gives a mcap of 30 crs. The sugar biz is in down cycle and hence the prices for all companies have crashed

Key mistake and learning – did not hedge on the down turn in sugar as I was thinking on 30-march.

Action plan – wait for upturn in sugar to exit the sugar biz. A sale at 60 and higher should work out in the deal. May have to sustain further drops before recovery.

Kesar enterprise stock recovers - Sept first week

Price now at 70 levels. Sell the stock!!

Kesar infrastructure yet to be listed - Dec first week

Was able to sell the sugar piece @65-70 prices. Deal which was expected to take 4-5 months at max has taken twice that amount – around 9 months already. No updates yet.

Stock finally listed - Dec 22nd

Kesar infrastructure finally listed at 99. A gain of 30% in nine months. May hold on to the stock

Key learnings

· Such arbitrage deals take longer than expected. Patience is the key here

· One cannot ignore short term implications on the stock price and treat it as a long term idea. If possible, options can be used to hedge the position only if the timelines are certain

· Build the arbitrage position over a period of time and not immediately after the announcement as the price drifts downwards once the buying/ selling pressure subsides

May 23, 2010

ABB buyback - An arbitrage opportunity ?

Dear Rohit,

How are you?

I wanted to know your opinion about ABB delisting. I have never done arbitrage but ABB has declared an open offer for 900 Rs and the shares, though jumped today to 830 Rs, still is at a 70 Rs discount to the offer price indicated by ABB.

I am not sure how one should think through this situation. I have invested some money today since the upside seems to be around 8% return in 2 months time. But I am wondering why the stock price did not end up at 880s level since the risk that ABB would withdraw the offer seems pretty low?

Is there any mistake in my thought process?

-----------------------------------------------------------------------------------------------------------

Hi pradeep

Good to hear from you. Thanks for passing this info. I had a look at the offer and below are my thoughts

- The offer is not really a delisting offer. ABB - the parent, holds around 51% of ABB India. This open offer is to buy around 23% of the shares to take their shareholding to 75%. The purpose seems to be increase control.

- the acquirer has stated in the offer document that they do not intend to delist the company.

See this link here : http://www.bseindia.com/stockinfo/anncomp.aspx?scripcode=500002.

Deal Math

Let’s look at the deal math:

If you buy 100 shares, you pay around 83000. With public holding at 49%, the acceptance ratio will be 50-100% depending on the tender levels.

For acceptance ratio we can look at the shareholding structure. On the ABB site, you can see that around 30% is held by institution and the rest by individuals. 10% is held by LIC.

The key to acceptance ratio is how the institutions will tender. If they don’t, then you get 100% acceptance and a 10% upside

If the some of the institutions tender then you have a ratio between 50-80%. Let’s take 70% for assumption sake - then 70 shares get accepted and you make 63000. Let’s assume the rest - 30 shares you sell in market at pre-deal rate of 700-720. The total value comes to around 83000-84000. I am not even assuming the market risk here.

Best case scenario - 10% gain

Likely scenario - 3-4% gain

And worst case - 6-7% loss

Overall the risk reward are not too attractive, atleast to hold till the tender date.

However you can adopt an alternative approach - Hold your shares for some time and exit when the price approaches 900 levels. That way you will get a decent gain and not face the downside risk. I have to caution you that this would however be a speculative option.

Additional thoughts (not part of the above email)

ABB is currently selling at around 40+ times earnings. It may be undervalued, though I find that very hard to believe. If you share my opinion, then buying the stock at 820-830 levels with the ‘hope’ of selling at a higher price before the buyback would be a speculative position without a valuation support to it. As a result I have given this deal a pass.

May 4, 2010

Quick arbitrage: HSBC investdirect

HSBC invest direct recently announced a delisting offer – see here. Ninad has analyzed this deal extensively on his blog (see here and the detailed analysis here). In a nutshell, the company was selling at around 280 per share and as one of the major shareholders had acquired the shares at around the same price, there was a high probability of the delisting price being above this price if the delisting is successful.

This opportunity appeared to have decent odds of making money – in other words the risk reward analysis showed a decent upside in a short period of time although with a real possibility of a loss. I am not repeating the analysis here as it has been done very well on ninad’s blog.

If you are thinking - is there is any original thinking here? You are on the right track – none! I am purely riding ninad’s coattails here :). I have been working with ninad, arpit and few others on various ideas and it has been quite a learning experience for me.

The process

There is a typical price action in a delisting scenario. There is a sudden price jump as soon as the delisting is announced. One has to then analyze the deal and figure out the probability of the delisting being successful and the price at which it will happen. This is a subjective assessment and requires the analysis of several factors as illustrated in ninad’s post. The most crucial aspect is also to evaluate the downside risk.

Once the assessment has been done, the next key step is to start building a position. Typically a few days after the deal announcement, the price may start to drift downwards which is when one can start building a position.

Once the delisting is announced, one has to track the reverse bookbuilding process and monitor the price at which the shares are being tendered. Typically if the tender price is higher than the pre-book building price, the stock price will start moving upwards.

One has to then make a decision on whether to hold on till the end of the book building process or exit at a moderate gain. I typically exit at a moderate gain. If however the tender price at which most of the shares are being is around your purchase price or lower, one should exit as soon as possible.

The result

So how did this short term arbitrage turn out? Fairly well and actually far better than expected.

I created a small position at an average price of around 283 per share and exited completely by Friday at an average price of around 325 for an average gain of 15% in a matter of 15 days.

The price has now jumped to 360+ as the majority of the shares till now have been tendered at 400. The delisting may or may not happen at this price as it depends on the management of the company. I have however exited my position as I was looking at moderate returns and did not want to risk losing money if the median price is not accepted by the management.

Learnings

For starters, identify smart people and coattail them :)

Arbitrage is a fairly profitable activity, especially in a stagnant or down market. It however requires a different mindset - an ability to analyze the deal quickly, take a position and be ready to exit or cut losses at the earliest. It is crucial to manage emotions – both greed and fear as it easy to get carried away.

Email discussion

If you are analyzing a deal or following it and would like to share it or discuss with me, please drop me an email on rohitc99@indiatimes.com with subject line – ‘Spl situation’. I will be glad to share my analysis, if am doing it or analyze the deal otherwise and share my thoughts with you. You can be assured that the discussion would remain private.

February 9, 2010

Special opportunity framework

In addition, I have upoaded a template which I use to track such opportunities (look for file – arbitrage delisting template).

---------------------------------------------------------------------------------------------------------

My friend Rohit had in his earlier posts detailed out the Elantas Beck opportunity and the various milestones associated with the special situation opportunity.

The objective of this post, taking the example of Elantas Beck, is to list down the framework (in our limited intelligence :) for managing a special situation opportunity and the thought process associated with it.

Before I run thru the framework and the thought process, let me just run thru a brief background about Elantas Beck.

About Elantas Beck

Elantas Beck is the subsidiary of Altana AG which is a specialty chemical major based out of Germany with operations spread across the world. Altana historically had a pharma business and a specialty chemical business. The company divested its pharma business and transformed itself into its current form.

Altana has four key divisions

1) ECKART

2) BYK

3) ACTEGA

4) ELANTAS

Elantas beck India is a 88% owned subsidiary of Altana and is aligned to the Elantas division globally. The other divisions at present have a marginal presence in the Indian market.

Process Framework

In any delisting opportunity and the same framework can broadly be applied across other special opportunities, there are 3 risk points in the transaction

1) Time Risk

2) Price Risk

3) Deal Risk

Let me address each of these risks with respect to the Elantas opportunity.

1) Time Risk

In any arbitrage opportunity even though the deal might go thru and at the price that we had defined, there could always be time delay involved in the deal which will shave off potential returns. This is especially true in the Indian context when there are court approvals required in certain special situation opportunities like mergers.

In the Elantas beck deal time risk was eliminated by constantly monitoring the milestones achieved in the deal. The entry point was timed only post the shareholder approval and once the company had filed with the BSE for the delisting process.

2) Price Risk - There were 2-3 ways to handle price risk in this transaction. This of course would be different for every transaction.

a) Valuation - As Rohit pointed out step 1 was to ascertain the fundamentals of the company and Rohit & Arpit (They are good at this :-)) arrived at a fair value of Rs 600 for the Elantas stock.

b) Ability / Inclination of the parent company -The interesting point is that the largest shareholder of Altana is taking Altana private and Elantas was the only listed subsidiary in the world. Market cap of elantas was 360 crores. So the parent would have had to cough up about 40-50 crores to do the delisting. It wouldn’t have been a big amount considering their balance sheet and 15-20% more wouldn’t have been difficult to stretch. Also having run their global balance sheet and other communication, it was clear that India was a high focus area for Altana and the other divisions were waiting to enter the country.

c) Expectation of market participants - When the delisting was announced ICICI emerging star had about 2.25% stake of the 11.5% public holding. They exited at around the 460-470 mark post the delisting announcement. So market participants who bought that 2.25% holding, at that price clearly bought it with an intent to tender it at a higher price in the delisting process.

Factoring in all the above variables Rs 600 was a reasonable estimate that was arrived for the delisting price.

3) Deal Risk - which brings us to the most imp variable in this transaction. We saw a high deal risk because of the dispersed nature of shareholding and out of the 8 lac outstanding shares there were 2 lac shares in the physical form. Though the current SEBI amendment has allowed physical holders to tender in the delisting process, we saw not too many shares getting tendered on this front.

Factoring in a high deal risk we defined 2 clear exit points which ever came earlier.

1) Price point - 520-525 levels (my comment: take advantage of the 10-15% pop in the prices)

2) Time point - Exit midway thru the book building process.

The call was clear not to wait till the reverse book building process closes and take whatever money was available on the table and not live with the deal risk. There is of course the behavioral angle to the transaction where the dopamine kicks in when one is actually in the thick of action and tends to not necessarily follow what was defined at the start of the transaction :-).

January 29, 2010

Clarifications on previous post

A few Comments and some emails on the previous post made me realize that understanding delisting norms is really not everyone’s idea of fun. So let me try to explain it in brief (while omitting some details)

If you hear a thud sound while reading this post, it is likely you have fallen asleep and hit your keyboard while reading this post :)

Delisting process

You can find the delisting norms here. In brief, the rules for delisting apply when a company wants to delist all its shares from the exchanges (i.e go private with no public shareholding). It needs to go through a prescribed process which can be described in short as follows

1. Board approves delisting

2. Company seeks shareholder approval for delisting the shares. For the delisting to be successful, the company has to buyback atleast 50% of the publicly held shares. So if the public holding is 11.5 % (as in case of elantas), then the minimum buyback has to be 5.75% of the total shares for the company to delist from the exchange.

3. Shareholders approve the buyback.

4. The company launches reverse book building to discover the price at which it can buy 50% of the outstanding shares. The shareholders tender their shares to the company at their desired price. If the company finds that more than the outstanding number of shares have been tendered and the price for the 50% of the shares tendered is within their target price, then they can declare the offer successful. The company is then obliged to buy all the shares that have been tendered at or below the declared price.

Let’s try to understand this with an example. For simplicity, let look at the case of elantas beck.

Elantas announced a delisting and the share price jumped from 250 levels to around 450 levels in response to it. Finally the company announced on 7-dec, that the board has approved a buyback with a floor price of 219 which is the minimum price based on the delisting norms. In addition the board approved a price of 330 as the offer price. This would be the minimum price paid to the shareholders, if the discovered price turns out to be at or lower than 330 during the reverse book building process.

The price was steady around 470-480 levels and as the reverse book building date approached, it crept upto around 500 levels. Finally after the first two days into the book building process, only .5% of the shares had been tendered and the price in the open market was around 525. As the probability of the success of the offer was low, I exited the stock completely booking around 7-8% gain over the deal.

At the end of the tendering period (around 6-7 days), the company received about 25-30% of the outstanding shares and hence irrespective of the price tendered (which ranged from 210-1100), the offer was not successful (as less than 50% of the shares had been tendered).

About the company

It is not crucial to know about the company in detail in an arbitrage or special situation such as delisting. However when analyzing such a deal, it is important to have a look at the fundamentals of the company and evaluate if the company is overvalued by a large margin at the current price.

Elantas beck is into specialty chemicals for insulation and construction industry. It has performed well in the last few years with an ROE in excess of 20%, zero debt and a 10% growth in bottom line. The company has cash equivalents of around 35 crs which is almost 10% of the market cap. At the time of delisting the company was selling at around 16-17 times earnings which is right around fair value of the company.

If the valuation at the time of the announcement is high, the downside risk of the deal is high if it fails.

The calculations

The matrix in the previous post is the expected value analysis. The formulae for expected value is gain*probability of gain+loss*probability of loss.

I estimated that the delisting price would be around 580-600 and hence there was an upside of around 100 Rs. On the downside I expected the price to drop to around 360-370 levels and hence a possible loss of around 110-120 Rs. The probability estimates for each of the events was a subjective number and it depends on one’s experience and guess.

All this work for a measly 7%?

The return was around 7% for 1.5 months, which works out to 56% annualized. My return expectations are 20% per annum from arbitrage over the course of the next few years. There will be some deals which will work out well and some where I will lose money. In aggregate i am targeting 20% or more. I don’t expect too much from myself :)

The advantage of arbitrage is that the returns are not correlated to market returns. If you can evaluate the deals well, the returns are independent of the market. This helps in reducing the volatility of the portfolio and it is always a better to have an additional tool to invest and make decent returns.

January 23, 2010

An arbitrage case study : Elantas beck

I think it was rightly pointed out by two readers that the post is a bit vague. I made the assumption that delisting norms are general knowledge and most people would be aware of it. In addition, i did not discuss much about the company too and the delisting process. I am writing up a post on these missing details and will publish it soon

--------------------------------------------------------------------------------------------

I have been working on some arbitrage ideas with my good friends ninad kunder and arpit ranka. Both are extremely smart investors and blog here and here. Ninad occasionally blogs about some of his arbitrage ideas on his blog and I would recommend following his posts on such ideas.

Following are my personal notes on the idea during the course of this opportunity. These are my personal notes. However based on my discussions with ninad and arpit who clearly have more experience on this, I later on revised my probabilities.

Opportunity (dated 11-Nov)

Elantas beck has announced a buyback for the 11.5 % holding. The current price is 460 which is 11 times earnings. The board approval is pending

Scenario analysis

Upside: likely 15-20% if successful

Downside: if the company delays, then price could drop down to 250 odds level (pre-delisting) levels. low probability of that happening. More likely to see a drop of 20% 320-350 levels. At that price the company would sell @8 times earnings

Probability of delisting happening : 70%

Expected gain is 6%

Plan : sell @ 525 and higher. if drop below 350, buy

Opportunity tracking

Update 12/7

company announced buyback. Floor price is 219. board has approved 330

final price will depend on price @ which 50% of balance stock (around 6%) is submitted

personal decision : hold stock till 1st week of jan and sell @ 520 or higher as the chances of delisting happening are low.

Update 1/14

Price at start of buyback was 525. Buyback may not be successful

sold off at average price of 497.1 for 1.5 month gain of 7.2%

Learnings

The deal values worked out as forecasted earlier. The price went up to around 520 and is now at 428. A 10-15% drop would make the stock attractive again.

The error in the idea was in estimating the probability of success of the deal. The deal success probability was much lower than expected. However due to the price action, the deal still turned out to be profitable.

Conclusions

There are several things which can go wrong. Always be conservative in estimating success of such special opportunities.

Follow price action of the stock to understand investor expectations of the deal and to make opportunistic gains. This is a new one for me as I rarely concern myself with such things for my long term ideas

Finally, it is profitable and a lot of fun to associate with smart people :)

July 31, 2008

Arbitrage Process - II

Joe Ponzio (Fwallstreet) is a value investor and writes extremely well on value investing with a lot of clarity. He has written several posts on arbitrage with examples of specific companies such as the tribune company. In this post, and this post he talks of the 7 broad steps in a merger or accquisition. These steps are mainly around the due diligence of the deal, signing a definitive agreement, getting shareholder approval and follwed by the regulatory approvals. Once all the approvals have been taken, the probability of the transaction happening is high

As Joe’s indicates,correctly in this post – ‘In arbitrage, the goal is to earn high rates of return on an annualized basis in low-risk, high-certainty situations’. So by investing in a transaction which is past the major approvals, an investor can be confident that the transaction will happen , which reduces the risk component of an arbitrage transaction.

I would recommend you to read his arbitrage related post to get a good understanding on the process.

What are the kind transactions which can be considered for arbitrage ? I have written on these transactions in the past and am listing them here again

Spin-offs

Mergers : These can be friendly in nature or hostile. Friendly mergers have lower risk and lower return. Hostile mergers have higher risk and correspondingly higher returns. Mergers can involve cash merger where the target shareholder is paid cash for their holding or stock for stock exchange or a combination of the two.

Bankruptcy or restructuring

Recapitalizations

Arbitrage helps in generating positive returns during a bear market. However the downside is that this investment category requires a lot of work for the small returns you get in return. As a result arbitrage may not be suitable for someone who is able to devote only a few hours a month on investing.

July 29, 2008

Arbitrage process - I

Deal announcement – This generally involves a press release or filing of an offer with BSE/ NSE with the requisite details. An investor has to be on a constant lookut for such announcements.

Gather and analyse information – After the investor comes to know about the deal, the next step involves gathering and analysing information.

The following are the various types of information which needs to be considered

Financial information: This involves reading all the filings with the stock exchange, Financial details of the companies involved such as the annual report, quarterly reports and analyst reports.

Legal information: gather and analyse any legal information which may impact the deal. For ex: check if there is an legal dispute in which the target or the acquiring company is involved, which may impact the success of the deal

Any tax and accounting implication should also be studied

Interpret and estimate – This stage involves the interpreting the information from step 2 and coming up with values for the following three variables

Returns estimate – The formulae used for the returns would as follows: Final target company price-Current price / Current price. In addition if the deal involves a stock for stock merger, then the investor should add the dividends to be received. If however the deal involves a mix of cash and stock, then the total return can be calculated as follows

(% of cash* amount of cash+% of stock * amount of stock)- Current price / Current price

If the transaction involves shorting the accquiring company stock and using borrowed money, then the return should be reduced by the dividends which needs to paid for the shorted stock and also by the interest cost of the borrowed capital.

Risk estimate – The risk in the transaction is the downside risk of the target company + Upside risk of the accquiring company

Downside risk = Current price – estimate of target company price if the deal fails

If the deal fails, and the investor has shorted the accquiring company stock to hedge, then he may incur an upsideside risk too

Upside risk = estimate of the accquiring company price if deal breaks – current price

The estimate of the prices for the target and accquiring company is done based on several factors such the pre-deal price, price of other companies in the industry etc.

Probability – This is the probaility of the deal coming through. The investor may assume there is an 80% probaility of the deal coming through. His estimate of returns my be 15% and estimate of risk may be 30%.

Based on these numbers the risk adjusted return is = .8*.15+.2*-.3 = 6%. This could be the absolute returns. If the investor expects the deal to complete in one month, then the annualized return is 72%.

It is important to consider the time it will take for the transaction or deal to happen and use that to estimate the annualized returns. The longer the time for the successful closure, the lower the annualized returns.

Estimation of probability is a very subjective exercise. An an investor one has to analyse the various subjective elements of a deal and estimate the likelyhood of the deal being successful.

The earlier one invests in a deal, the more the uncertainity and hence higher the spread. In the event that there are multiple scenarios possible for a deal such as possiblity of a white knight appearing, then the risk/return of each scenario needs to wieghted with the probability of that scenario to arrive at the estimated returns for a deal.

Next Post : Other resources to understand the arbitrage process

March 10, 2008

Kothari products demerger – an arbitrage opportunity ?

has approved the proposal for scheme of arrangement between the Company and Pan Pang India Ltd., for demerger of Pan Masala Division, Bevarages Division and Trading Division into Pan Parag India Ltd., subject to approval of the Stock Exchanges, its shareholders and the Hon'ble High Court and the necessary approvals under various statutes. Further the Company has informed that, the Board of Directors has also approved valuation report of M/s. Haresh Upendra & Co. Chartered Accountants, recommending exchange ratio of 1 Equity Share of Rs 10/- each of Pan Pang India Ltd for every 1 Equity Share of Rs 10/- each held by the shareholders in the Company. The Scheme of Arrangement provides for the exit to small Shareholders holding Equity Shares in Physical Form.

My earlier views on kothari products are here and here

Following is a comment from the 2007 Annual report – director’s report

In view of the risks associated with the Pan Masala Industry in the form of Governmental bans, the Company has decided to diversify into the business of Real Estate, constructions, builders etc. which is a booming business presently and which is growing at a very high speed. The market presents an attractive investment opportunity in the area by virtue of diversification. Your Company with requisite financial strength and proven managerial skills, stands in a position to seize the opportunity. To avoid any adverse impact on the growth of new business, management is considering various options for restructuring to seperate other businesses in a most efficient and transparent manner.

I am looking at kothari products as a short term arbitrage opportunity based on the following hypothesis – demerger would unlock the value in the company.

Kothari product would demerge the pan masala and other associated business from the parent company. The post de-merger company will be into real estate and construction business. The sum of value of kothari products (post merger) and pan parag ltd should be greater than Kothari products (pre-merger)

My question

1. Does the shareholders get 1 share of panparag and Kothari products (post de-merger) each based on 1 share of Kothari products (pre-demerger) ?

2. What happens to the Investments and cash on the books ?

Would appreciate any inputs on my questions ?

Please read disclaimer on the blog.

April 24, 2007

You can be a stock market genius – Recaps, stub stocks,warrants and options

The stock after the recap is called as a stub and an investor can benefit from buying such stub stocks after the announcement of the recap. The reason for this is that the stub is a leveraged position on the stock. As the company has high amount of debt, the equity value is depressed due to high leverage. As the company pays off debt, the earnings grow rapidy. Also the multiple could expand at the same time due to reduction in the risk. As a result a small improvement in the debt level can result in a large improvement of the stock price.

Recaps are rare (and even rarer in the indian markets). As stubs via re-caps are rare, the same result can be achieved through LEAPS (Long term equity anticipation security). Leaps are a form of long term call options on the company. They are a leverage call on the medium to long term performance of the company. For sake of an example, lets assume that the stock price of company is Rs 88 / share. The company is highly leveraged and I feel that the company should do well in the next 1-2 years. I could (theortically speaking) buy a LEAP at 50 Rs/ share. If the company does well and the stock goes to 150 Rs/ share in two years, my gain would be 300%. The downside is that if the stock goes below the strike price, then I lose my money completely. LEAPS are thus a leveraged bet on the performance of a company. However, I think the indian market does not have LEAP securities yet.

Warrants provide an alternative route to put in a leveraged bet on the performance of the company. Warrants however have an advantage that their duration is much longer than options and LEAPS. The book has specific examples on recaps and all the other specific arbitrage options like spin-offs, arbitrage, and merger securities.

For all the previous posts on the book

Introduction

Bankruptcy and restructuring

Arbitrage and merger securities

Spin-offs

April 19, 2007

You can be a stock market genius – Bankruptcy and restructuring

It is rarely a good idea to purchase the stock in a company which has recently filed for bankruptcy. As the stock holders have the lowest claim when a company files for bankruptcy, usually they end up getting very little or almost nothing at the end of the bankruptcy proceedings.

One way to make money off bankruptcy is to invest in the debt securities of such a company which may be selling at 20-30 % of the face value. However this is a very specialized field which is best left to experts who specialize in this field.

The best way to profit from bankruptcy is to invest in the new common stock of the company which is issued after the completion of the bankruptcy proceedings. Since the stock is issued to the current creditors like banks or suppliers, they are rarely interested in holding the stock due to which there is a selling pressure after the new common stock is issued. This creates a situation similar to spinoffs. However it is critical that the investor analyses the company in detail before buying the common stock as random purchase of such stocks that have recently emerged from bankruptcy will rarely result in superior long term performance. There are several reasons for it. One reason is that most companies that have gone through bankruptcy were in diffcult or unattractive businesses to begin with and shedding debt obligations does not change the basic economics of the business ( think airlines). However if the investor does reasonable due diligence, then he would be able to find a few attractive opportunities which the underlying economics of the business is healthy.

The next area of opportunity is corporate re-structuring. If there is a major re-structuring of a company where a major division is spun off or if a losing business is sold off then such an event can create a profitable opportunity. After spinning off the weaker or money losing division, the resulting company is more profitable and focussed and may be given a higher multiple by the market. In addition the re-structuring can create a more focussed and efficient enterprise which may perform better in the future. Investing in the company after the re-structuring is over can be a profitable option.

Previous post on arbitrage

Previous post on spin-offs

April 5, 2007

You can be a stock market genius – arbitrage and merger securities

Risk arbitrage involves two kinds of risk. The first risk is event risk. The deal or merger may not go through due to various problems such regulatory issues, financial problems, unforseen events.

The second nature of risk is the timing risk. For ex: A company A announces the buyout of another company B. Company B trades at 200. The buyout offer is at a premium of 20%. As a result of the announcement, the stock rises to 230. This is still below the deal price of 240 and give rise to an arbitrage of 10 per share (4.3%). Now the time take for the deal to play out will have a big impact on the eventual returns. If the deal takes 2 months, the returns are 25%+. However if the deal takes a year, then the return falls to around 4% which is below the risk free rate.

Finally the area of risk arbitrage is now fairly competitive and the typical returns have come down over the years. As a result the risk/ reward equation is not compelling in several situations and hence the author advises that non-professional investors should stay away from this area of arbitrage

The next sub-topic is on merger securities. These are securities such as warrants, bonds, shares etc which are issued by the acquirer to pay for an acquisition. These securities, issued during the merger, may not really be desired by the large investors for various reasons (similar to the spin-offs). The reason could be the restrictions on the institutional investor such as a stock fund may not be allowed to hold bond securities issued during a merger. In addition some securities such as warrants may not be large enough for the large investors to get interested. Finally due to the various reasons, these securities are sold off without regard to the investment merits. As a result these securities can be purchased below their intrinsic value

Thus merger securities are similar to spin-offs and an investor who is able to do a certain amount of analysis and due-diligence may be able to profit from both the special events.

My thoughts : I have seen a few merger and acquisition announcements in the past. However these coporate events are not as frequent in the Indian market as compared to other foreign markets. Also the pricing in quite a few of these merger announcements is fairly efficient and these is little opportunity for a small investor to earn a good return (without leverage). However it is still a good area to investigate if one is interested in extra returns. A word of caution though – aribitrage of any kind requires continous effort and may not be too truly appropriate for a part time investor.

March 29, 2007

You can be a stock market genius – Spin offs

For ex: when reliance was split into the petrochemical, communication and other businesses, the shareholder were given shares in the spun off divisions based on the valuation of each business.

Spin-offs may partial where the parent wants the market to realize the value of the division and so by doing a partial spin off, the newly spun off company is now valued by the market independently. This enables the company to demonstrate the hidden value of its subsidiary and get a better valuation for the whole company.

In addition there are a few additional reason for spin-offs

a. The company wishes to spin-off a poorly performing division and improve the valuation of the parent company

b. In a regulated industry, by spinning off the regulated division, the parent can operate in a non regulated environment c. The company wishes to improve the valuation of the company by making the subsidiary an independent company with its own management and policies. This improves the valuation of the parent and the spun off company as both can now focus on their core businesses.

The reasons why spin-offs create an opportunity for the investor are listed below

a. The spun off division may be very small with a low market cap. As a result large instutional investors may not be interested in holding it due to various constraints. This creates a selling pressure and drives down the price.

b. The spun off division with its independent management can now focus on the business better and hence perform better in the future

c. The market may give a better valuation to the spunoff business depending on the nature of the industry in which it operates

update : 03/29

An additional approach to profit from spin offs is to look for situations where the company plans to conduct a rights issue instead of an outright spin-off of the subsidiary. In such cases the company is planning to 'sell' the division to its shareholders via a rights issue and raise some capital at the same time.

This modified and rare type of spinoff approach is profitable for the same reason as the usual spin off. In such cases large institutional investors may not subscribe to the offer due to illiquidity of the new issue. In addition if the spin off via rights is beneficial to the insiders , then it would make a lot of sense to subscribe to this spin off via rights purchased from the market or via direct purchase of the parent company's stock.

An additional point repeated by the author several times in this section is that an investor should analyse closely the actions and motivations of the insiders during the spin off. Does the spin-off benefit the insiders ? do they have a stake on the upside ? Answers to these questions would help an investor make a good decision

March 27, 2007

You can be a stock market genius - Introduction

- 8-9 stocks can help one diversify almost 80-90% of the non-market risk. With 20+ stocks the non-market risk reduces by almost 95 % (quoting from memory)

- don’t depend on broker recommendations. They are baised on buy side as they make commision if you buy stocks. Also as there are always more stocks to buy (for an investor) than to sell (one’s holding is limited in comparison to the total universe of available stocks), brokers are more interested in generating buy recommendations. Have seen the same in india. As a result I tend to look at sell recommendations more closely than buy recommendations.

- small cap and midcap is a fertile ground to find undervalued stocks as these stocks are neglected by brokers and also by large investors due to various size, legal and other types of restrictions.

I will keep posting more notes as I continue reading the book

December 6, 2006

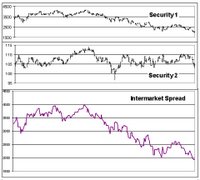

Postmortem of an arbitrage opportunity

At the time of analysis the stock was selling at 210. Based on a quick analysis, I felt the intrinsic value for the stock was around 180-190. As the terms of the buyback stated that for any holding greater than 50 shares, the acceptance ratio would be around 14%, I passed the opportunity as I felt that post the buyback, I may not be able to sell the stock at a price higher than the purchase price and I was not comfortable buying and holding the stock at 210.

Well my thesis proved to be correct, but I still missed an opportunity as I did not track the stock subsequently. Let me explain,

If I had bought the stock at 210 and attempted to arbitrage, I would have suffered a loss of 16% on my investment (assuming a sale price of the stock at 170 after the close of the buyback on 8th August).

However had I continued to track the stock, there was a buying opportunity in june (see graph above, around 8 – 15th) when the stock traded briefly between 115- 140. A purchase at that price (and sale at 170 after buyback) would have given me an annualised return of 135 %.

So lesson for me is that I need to keep tracking an arbitrage stock till the end of the event to take advantage of any sudden opportunities which may come up.

April 8, 2006

Follow up on the Infomedia ltd arbitrage

Following are my observations/ conclusion from what I read in the AR

- Infomedia is a fairly profitable company with a networth of 155 cr and a cash and equivalents of 126 cr.

- The company has a Return on capital in excess of 30 % (invested capital net of cash, net profit excluding exceptional items)

- The company is a zero debt company and is does not have a very capital intensive business.

- The net profit growth in mid to high single digits (7-9%).

- The publishing/ printing industry is growing at a moderate rate ( 8-13 % on avg - see macmillan performance which has a similar business as Infomedia)

- A fair valuation would be around 16-20 times free cash flow. Currently the free cash flow seems to be around 7-8 Rs / share. I would at best value the company at 160-180 Rs/share. So at 210 the company seems to fairly valued. Defintely not a long term buy at the current prices

So if I put the price after the buyback at around 180-190, the annualised return seems to be around 30%. Ofcourse the post-buyback price is just a guess on my part.

I still need to find how tendering of the shares is done? Does the company send some documents to the investor and is the investor supposed to fill up some papers to tender his shares? If anyone knows how the process works, please let me know or leave a comment.

April 4, 2006

Arbitrage opportunities

With the market at current levels, I am not finding too many long term opportunities. Maybe my criteria is too stringent. But for my long term holdings I am not too keen to relax them.

In addition there aren’t too many graham type value stocks either. That kind of leaves out only aribtrage opportunities. Although I have not done much on it in the past, I have started looking at this area of investment opportunity actively. Atleast looking at arbitrage opportunites would keep me busy till I find a long term opportunity and hopefully prevent me from doing something foolish (which I may still end up doing)

There two opportunities which have come up. One was point out by amit in the comments. I also found reference to it on the icicidirect website ( see here )

The first company is infomedia india ltd. This is a buyback offer from the company.

- The salient features of the scheme are as under:

- The company shall buy back equity shares representing 14% of its paid-up equity capital. The buyback shall be across the board.

- The consideration for buy back shall be Rs 245 per equity share.

- Shareholders holding less than 50 equity shares per ledger folio / Client ID will have the option to tender their entire holdings over and above 14% of their shares at Rs 245 per share.

- The shares so bought back shall be cancelled.

- The scheme as envisaged will not affect the shareholding pattern of the company materially.

- The scheme is subject to such approvals as may be required including that of the stock exchanges, Bombay High Court, shareholders and creditors.

The buyback is at 245 Rs per share. The current price is 210 per share. So technically there is 16 % return. Let me take you through my thought process on the above offer

ICICI ventures is the major shareholder with the shareholding at around 72 %. So the free float for the stock is 28%, which is 50 % of the open offer. So there is good probability of 50% of the tendered stock being accepted (maybe more).

I have found this excel arbitrage evaluator . So based on this evaluator, the following needs to be estimated further

- Probability of the buyback not happening – looks low at less than 5 %

- Closing price after buyback – This is a key variable to figure. As there is a likelhood of 50% or more of the stock being accepted, there rest will have to be sold after the buyback offer. Now one can choose to hold the stock, but that would require more analysis.

- Duration of the scheme – looks like 1.5 to 2 months.

I can see a best case return of 40-50 % (annualised, net of expenses) in the above case. The key issue to figure out the downside and whether it can be mitigated by holding the stock for long term(more on that in future posts)

In addition to above, I am looking at two more of the following

- EDS bid for Mphasis ( see here ) : No opportunity here, as the offer is at the almost the current market price. But I would like to see if EDS would up its offer (unlikely that the current price will get a lot of response)

- Micro inks : I have just been emailed the AR for the company. I am now looking at this company as both a long term opportunity or a possible arbitrage opportunity in the future (if there is a possibility of a buy back or reverse book building by a german co – don’t have much info on it though)

Disclaimer – I am not recommending any stocks / aribtrage on my blog. Even if I am excited or find something interesting, I may not invest any money into it if it does not add up.

April 3, 2006

Learning Arbitrage

I just came across these two posts by prof. Bakshi which talks of two such arbitrage opportunities

http://fundooprofessor.blogspot.com/2006/04/nothing-ventured-something-gained.html

http://fundooprofessor.blogspot.com/2006/04/creating-free-warrants-case-of-jsw.html

I think Prof bakshi has explained the two situations in a fair amount of detail and anyone wanting to learn about arbitrage opportunities should read these two posts.

I am looking for some books on arbitrage and till date have found a bit of an explaination on it in warren buffett’s letters to shareholders and in Benjamin graham’s books – ‘The intelligent investor’ and ‘Security analysis’. However I am still looking for some books which covers this topic in detail, especially risk arbitrage, M&A arbitrage etc.

If anyone of you know a good book on it please leave me a comment. I would really appreciate it.