I got the following comment from abhijeet on my previous post. Instead of replying directly to the comment, I thought of putting my thoughts on options in a separate post.

I have been studying options and futures on and off for sometime (read a few books on it). However I am still not an expert or anywhere close to it to commit a meaningful amount of money to a position. However as a start, I have started looking at options as a defensive strategy. Let me explain

For various reasons I do not have a firm opinion on the valuation of IT firms. One can argue that the future is bright (see the latest issue of business today for no. of IT deals coming up for renewal this and next year), but at the same time there are several known factors which could upset the applecart. In the end there is little margin of safety in the true graham sense.

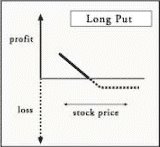

So if I hold IT stocks and have a fixed time horizon to sell the stocks, then buying put options is good strategy to limit the losses (and still have an upside). However this strategy is not a costless strategy. It may not be a strategy with a positive expected value. But buying puts acts like an insurance. In the end it would prevent something truly bad from happening to my portfolio, but it is not strategy to make money.

I still look at using options as a defensive strategy as I am not comfortable with an approach which could have an unlimited downside.

Covered call writing as mentioned in comment could be strategy to make money, but I have not tried it at all and not sure how much I could make (net of all the commissions, spreads on the options) unless I had a strong opinion on the stock on which I am writing the covered call. The other risk which I see in options is that not only one has to be correct on the stock, but one has to get the timing right (which I am very bad at – have been wrong more than 50 % of the time whenever I have tried timing)

In the final analysis, even if I am not planning to put any significant money in options, I see a definite value in learning about it.

4 comments:

Another way one can use covered call writing strategy is when you have made good returns on the stock, but not sure if you want to sell it (very difficult to make that sell decision cause sometimes one can be unsure if it is valuation are reached and one is still trying to figure out if company is going to do well in long term). You can write a covered call for that stock, if you do get the buyer you collect premium and that adds more returns to your stock and if you get the call you will have sell it at the strike price which would be less that the market price (which is the downside) but you will still have made the profit.

abhi

are you not limiting your upside by writing a covered call, but at same time exposed to the downside

True and that is why I think it is better to make covered call strategy when you think you want to sell the stock, you may lose up on the a biton the upside but then you made the sell decision based on you think the company cannot add any more value and has fully reached its valuation.

It is a indivdual's decision to take soem profit out or be greedy and wait for little bit of upside.

When you factor in trading and excercise costs, I think options are a suckers game for 99% of investors.

Most people, even if they they think they can, are not able to take on the huge risks and volitility, of fooling around with options.

Post a Comment